|

|---|

Friday, 30 October 2009

Thursday, 29 October 2009

In an interesting article in today's Globe & Mail, Martin gives us a very pithy, very apt, and very useable definition of the politics practised by our current prime minister: brutish.

"In Jean Chrétien, he was marketing a populist; in Michael Ignatieff, someone who was to the manor born and who must stake out that higher ground as opposed to being dragged into the pit of tactical games and brute politics that Stephen Harper relishes."

Let us all hope that Harper's style of politicking leads to his foray into the prime minister's office as being one that is nasty, brutish and short.

Especially short.

Wednesday, 28 October 2009

Two weeks before he was asked to join Michael Ignatieff's team, pollster Donolo had this to say about the tactics of the Liberal Party:

"He needs to find issues that have sharp edges to them and that serve as really sharp wedges between him and the government. And he needs riskier events to do that."

The Cat agrees with that advice, and offers a sharp edge for the Liberal leader and his new Chief of Staff to consider.

LIKE IT? CLICK HERE TO READ MORE

Labels: framing, Ignatieff, Liberal Party, policies

Thursday, 22 October 2009

Darryl on Rex Murphy (St. John's Telegram)

I appreciate the tip from Rotarian Ian. It looks like the St. John Telegram quoted me on a Rex Murphy article.

Blogger Darryl Wolk chimed in: "Rex Murphy does a great job with this commentary on the Alberta oilsands and the recent photo spread in National Geographic."

-Darryl

***

The Telegram (St. John's)

Life & Leisure, Saturday, October 3, 2009, p. D1

The World... according to Rex

'National' commentator unleashes brand new collection of his opinions

Ashley Fitzpatrick

Maybe it was something he said on CBC's "The National" about the feud between Stephen Harper and Danny Williams.

Or perhaps it was something he wrote in the Globe and Mail on Afghanistan or Tim Hortons, on Obama or Madonna.

Whatever the topic of commentary, there are moments when Rex Murphy just gets it right - spot on.

Some of those moments are collected in his latest book "Canada and Other Matters of Opinion," copies of which will be on sale during a free Evening with Rex Murphy on Monday at Memorial University's D.F. Cook Recital Hall, School of Music, 7:30 p.m.

Murphy said moments in his work are subjective and he finds them only a handful of times in a year of work.

"Every now and then, everything connects," he said.

Those moments are jewels. Yet it is a rare commentary that gets nothing but applause.

In the Feb. 26, 2009 Point of View segment on "The National," headlined "High-Minded Hypocrisy," Murphy responded to the release of a National Geographic article on the negative environmental impact of Alberta oil projects.

The article included multiple high-quality photos, including aerial photos of the tar sands.

"What comes out of that 'necessary ugliness' is what's missing - the dignity of the person or family who found a job; the rescue of one region of the country by the prosperity of another; the smooth running of cities, manufacturing, the building of so many other necessary things. You can't take a picture of misery that didn't happen - or of hard times forestalled or mitigated," Murphy said in the television piece.

His piece got plenty of response, including this uncredited entry on the blog Let Freedom Rain (http://letfreedomrain.blogspot.com):

"Science is an inconvenience to wingnuts like Murphy. Like so many other authoritarian parents, teachers or preachers, he wants Canada to bow down in thanks to our father Alberta for all the shit it is doing to our environment."

On the CBC's website, a viewer named David Wilson posted a comment that said, "like many an over-educated and under-inspired old soak before him, our Rex indulges in highly entertaining but sentimental and ultimately vacuous rhetoric."

There were others as well.

"A brilliant commentary from Rex Murphy," Duncan Laidlaw wrote on the site. "Getting oil out of the ground in any way shape or form is dirty nasty business. Ask anyone who has ever worked on a rig."

Blogger Darryl Wolk chimed in: "Rex Murphy does a great job with this commentary on the Alberta oilsands and the recent photo spread in National Geographic."

Such is the life of the high-profile columnist - full of highs and the lows.

Murphy's new collection of commentaries follows his 2005 release, "Points of View."

The new book has commentaries separated into subtopics with titles such as "Obama Rising," "The Evil That Men Do," "The Canadian Identity" and "Newfoundland."

"Canada and Other Matters of Opinion" has an introduction by Murphy, as well as scattered grey-boxed additional thoughts to various column writings. (Read the book to find out what Murphy considers as "absolute proof that 'Never Again' was never a resolution - just a convenient slogan.")

While he is known to tell it like it is, albeit with a more creative use of language than most, Murphy said in a phone interview with The Telegram recently that he doesn't want anyone to take the commentary too seriously.

"I hope it's mildly amusing, and maybe it catches people's interest," he said.

The collection is a thought-provoking read, but also offers an opportunity to recall moments in time.

"We're in such a speeded-up age," Murphy explained. "Who remembers now when Hillary was so far in advance and Obama was a longshot?"

"We hop and skip across the most recent things, (but reflection) can serve some purpose and we can see some strands develop."

The title, "Canada and Other Matters of Opinion," reflects his own feeling about the country - that the Canadian ideal, the "common themes" and "strings" that tie the country together, are becoming harder to identify.

"I find that's woefully underarticulated," he said.

For example, Murphy said when then-prime minister Jean Chretien made the decision not to send Canadian troops to Iraq, the PM passed up an opportunity to talk about the country's history or its shared ideals.

"He missed what, I thought, was a rather magnificent occasion," Murphy said, "not for just announcing the decision, but for integrating it into the idea of the overall contract or compact that we have evolved. We drift forward and we don't tie the pieces together."

But Murphy makes those connections and attempts to provide context, asking people to consider what the loss of the East Coast outports or the rural family farm in Western Canada will mean to the country as a whole.

They are his opinions. But maybe they will spark a larger debate, a growth of the collective consciousness of a country.

Or maybe they'll just get him called a "wingnut" one more time.

afitzpatrick@thetelegram.com

© 2009 The Telegram (St. John's). All rights reserved.

Labels: Darryl Wolk, Rex Murphy

With Republican senators dogmatically opposed to a public health care system similar to the very efficient and morally justifiable Canadian and certain EU systems, and with conservative Democratic senators siding with the right wingers, the prospect of the US having a public health care system option as part of the legislation now before the Senate and the House was dim indeed.

But now there is life in the public option again, because some senators have found a new way to skin the cat and allow them to vote for a public option without losing votes in their states.

LIKE IT? CLICK HERE TO READ MORE

Labels: USA

"And no one in power wants to talk about the problem."

That is the stark message in the latest of the Globe & Mail's significant series of articles on the miserable state of the country's pension plans.

The Cat's challenge to Michael Ignatieff is to dare to be innovative, and emulate Hotspur – he of the "Out of the nettle, danger, we pluck this flower, safety" quote.

The G&M goes on to say:

"Despite the middle-class retirement shortfalls that are obvious to pension experts, politicians and business leaders seem fixated on patching up existing systems.

Attention and resources get focused on underfunded corporate plans, and on a tired debate over the merits of defined-benefit schemes, where the employer makes good on shortfalls, versus defined-contribution plans, which shift market risk to employees.

There is very little talk about enhancing pensions for the majority of the population that lacks any retirement safety net. University of Toronto pension guru Keith Ambachtsheer says: “Rather than defending old faulty designs, why haven’t pension industry leaders been searching hard for designs better suited to delivering 21-century retirement living standards that are adequate, universal and sustainable?”"

Let's examine who is covered by pension plans, and what kinds of plans there are, before going on to my recommendation to the Liberal Party for an innovative solution.

One key is to understand the buzzwords in the industry, starting with DB and DC:

"Traditional pension plans are DB, defined benefit. A retiree covered by the plan is guaranteed a given level of income. If the plan falls short, the employer is on the hook.

The new model, increasingly favoured by employers, is DC, defined contribution. In this approach, the employer’s responsibility is limited to making a certain (“defined”) contribution to the employees’ pension plan. Contributions made by both the employer and employee go into an individual account for the employee, who makes his or her own investment choices. If the plan falls short, the employee is on the hook."

Instead of using the word 'defined', I find that it helps to use the word 'definite'.

The difference between a Definite Benefit company pension plan and a Definite Contribution company plan is where the risk lies.

Under a Definite Benefit plan, the company promises or commits to the employee that he or she will get a definite pension amount each year upon retirement. The company bears the risk that it has not made enough investments, or the markets (stock and/or real estate) have fallen, so that there are not enough assets available to pay the definite pension amounts.

Companies – aided and abetted by governments at the federal and provincial levels (Conservative and Liberal), long ago decided they did not want that risk, and so stopped the DB plans and moved to the Definite Contribution plans, which shifted the risk of inadequate assets on to the shoulders of the employees.

So we have had a major shifting of pension risks from the corporate sector to the employees over the years, put in place by the economic and political elites of Canada.

The second major shift that the political and economic elites in Canada have brought about in the past quarter of century is to allow a big whack of Canadians to fall between the cracks, ending up without any corporate pension plans.

In 1945, when the Second World War ended, 19% of workers in the private sector had company pension plans. In 1960 this had risen to a whopping 40%. But by 1977 35.2% of workers in the private sector had pension plans; this has fallen by about a third, to 25.5% in 2007.

From 40% in 1960 to 25.5% in 2007. Down by 38% in 47 years, a drop of almost 1% per year. A time when both Liberal and Conservative parties ran our central government.

And so we have a large majority of workers in the private sector in Canada who do not have a pension plan.

The economic and corporate elite finessed this debacle by introducing the concept of retirement savings plans (RRSPs). Canadians who did not have public sector or company pension plans could provide for their retirement by making investments, with the ability to deduct such payments (up to a certain annual limit) from their taxes.

People can take care of themselves, the argument went.

There is no need for the Nanny State to step in and sort out the mess.

And that right wing framing of the issue still reigns today.

Imagine how different we would have been if instead of buying into the right wing Nanny State framing of the pension issue, we had instead adopted the framing of what a responsible state would need to do.

For example, leaving it up to the individual sounds good, right?

But only 31% of those who do not have public sector or company pension plans actually do invest in RRSPs.

That means more than two thirds do not – and that is a measure of the failure of the RRSP substitute for company pension plans if you need any measure!

Some have advocated using a third type of company pension plan, a hybrid one combining elements of the DB and DC plan, called by some a 'target benefit plan':

"In this model, plans target a certain level of benefit payout that appears safely achievable. But if long-term investment performance makes that target unreachable, funding is not increased. Rather, the benefit level is lowered. Conversely, if investment returns exceed the target, the benefits can be increased."

The risk that the assets will not be enough to pay an adequate pension should be shared between employers and employees in a hybrid, but (as the plan quoted by the G&M in the above article shows), such hybrids can shift most of the risk of non-performance onto the employees:

"Another key feature of the plan is that the member companies make a flat contribution on behalf of workers, set as a percentage of their wages. That is their only funding requirement: If the plan is short of money, employers don’t have to cough up more to repay shortfalls. Instead, the plan has to cut benefits for workers or retirees."

In order to properly protect workers in hybrid plans, there is a need to invest the funds in assets which are relatively immune to stock and real estate market risks (such as government bonds).

How big is this problem?

We have 17.6 million Canadians working. Of those, 11 million (63%) have no pension plans. Of those 11 million, only 4 million have RRSPs (leaving 7 million without even RRSPs, and totally dependent on the CPP and OAS payments when they retire. More than half (55%) of the pension plans of the 4.5 million workers with pension plans have DB (defined benefit) plans that guarantee the pension income of retirees until they die, are held by public sector employees.

And the average pension per year is $25,000.

Back to Michael Ignatieff, and the opportunity he now has to solve the problems of so many seniors in a decisive way.

The opportunity for the Liberal Party to come up with an innovative solution to the pension debacle is there. My best guess is that such a solution will take this shape:

1. Everyone who earns income (whether employed by a company or self-employed) must be forced to put aside a certain portion in a pension plan. Leaving the choice open to individuals simply shifts the risks that they turn 65 and don't have enough to live on, onto the rest of the taxpayers. You earn, you pay should be the model.

2. A new hybrid model is created, with contributions each year coming from the employer, the employee and the central government. Let's call the new hybrid the Canada Minimum Pension, or CMP.

3. Workers may contribute additional amounts to their own RRSPs, up to some limit.

4. Companies may make additional contributions to employees, if they so wish.

5. The only Defined Benefit (that is, definite benefit or pension payments) will be made from the amounts invested in the CMP.

6. Canadians will still qualify for the existing Canadian Pension Plan (CPP) and Old Age Security (OAS), in addition to the CMP payments.

7. All funds in the CMP will be invested in newly designed Government of Canada bonds of various maturities. The interest paid on such bonds will be re-invested in the new government bonds, so as to build up capital.

8. The total amounts which individuals can contribute to RRSPs will be reduced. This means their tax deductions will be reduced, and the earnings on the investments they might have made under the older higher level will not be made and so not be sheltered from taxes. This will result in the central government receiving more taxes. However, such higher taxes will be partially offset by the payment by the GOC of the interest on the new bonds.

9. Company obligations to pay under funded commitments of company pension plans will rank ahead of all creditors (including secured creditors, who will have to take heed of such liabilities before lending to companies), so as to protect workers upon the bankruptcy of the company (currently, workers rank as unsecured creditors against the assets of bankrupt companies which have failed to fund their company pension plans adequately). Nortel employees, for example, stand to lose one third of their pensions because Nortel went bust.

The major obstacle to reform of pensions is that no level of government in Canada wishes to grasp this nettle, preferring to tinker with changes rather than address the problem that millions of Canadians do not have any pensions (company or RRSPs) other than the CPP and OAS.

How to solve that problem?

One simple solution would be for the Liberal Party to state that should it become the government it will change the law governing the payment of pensions to MPs to one which pays MPs a pension based on the Canadian average pension (let's call this the CAP). In calculating that average, the total amounts paid each year as pensions will be divided by the total number of senior Canadians (including all those who only get the CPP and OAS).

By committing to the CAP for all MPs, the Liberal government will ensure that all MPs pay attention to methods to increase pensions of all Canadians so that all senior might have adequate pensions, rather than having millions with fat-cat public service or corporate pensions, and millions without any pensions other than the paltry $17,000 a year.

How about it, Michael Ignatieff?

Labels: pensions

Wednesday, 21 October 2009

Tuesday, 20 October 2009

Monday, 19 October 2009

Sunday, 18 October 2009

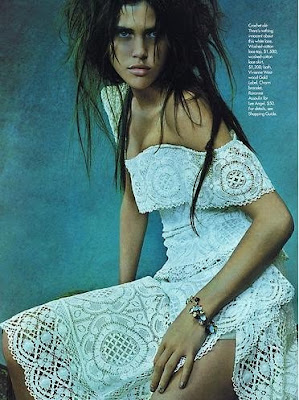

She was approached by an agent from top agency Storm, the same agency that is also responsible for launching Kate Moss’ career, and Jourdan signed with them in 2006.

In February 2007, Jourdan made her runway debut at the Autumn / Winter shows for Marc Jacobs, Ralph Lauren and Salvatore Ferragamo in New York and Milan. In September, Vogue named her a ‘rising star’.

Jourdan’s success continued, with runway appearances for Alexander McQueen and Hermes in Paris, and in February 2008, Dunn got the attention of the mainstream press when she became the first black model to walk for Prada in over ten years. The last black model to do so was Naomi Campbell.

The year continued to bring new honours, including accompanying designer Peter Som to the Costume Institute Gala in May, scoring her first Italian Vogue cover in July and also undertaking an ad campaign with British high-street giant, Topshop.

The cool, street-wise series of images, shot by Emma Summerton, launched Jourdan into the big-time: every fashion-conscious teenager now knew her name and face.

The lucrative professional relationship between Dunn and Summerton continued with editorials in Italian Vogue, and in November, a cover of British Vogue, with Dunn appearing alongside Eden Clark and Rosie Huntington.

In November 2008, Jourdan was nominated for and won ‘Model of the Year’, as voted for by the British Fashion Council. She topped the year off with a cover of French Elle. In February 2009, she opened the Autumn / Winter collection for Jason Wu, plus appearing in shows for Oscar de la Renta and Vivienne Westwood. She also had the honour of closing shows for Betty Jackson, Issa, Thakoon and Twenty8Twelve.

This brief summary of Jourdan’s career to date (temporarily on hiatus due to a pregnancy announced in July this year, with the baby due in December), shows that designers are definitely willing to hire (and re-hire) a black model.

Race in fashion is a contentious issue – even more so than weight. It has been said with alarming regularity that fashion, as a whole, is racist – deep down to its very core. It is true that even a cursory glance over a variety of fashion publications that the editorial balance is skewed in favour of white models, both in terms of editorial content and ad campaigns.

But the astonishing rate, at which Jourdan’s career blossomed, belies this idea. How can fashion be racist and still rave over beauties like Dunn? Jourdan herself was interviewed by iD magazine and refuted the notion that the industry will only hire a small number of black models at any one time. A brief scan of Jourdan’s friends within the industry also questions this commonly-accepted idea: Emanuela de Paula (Brazil-born), Sessilee Lopez (America), Honorine Uwera (Rwanda) and Arlenis Sosa (Dominican Republic). This is not a roll-call of an industry only interested in promoting a blonde, blue-eyed template of beauty.

These names are not necessarily well-known outside the immediate fashion industry, but Jourdan has certainly not been alone on her rise through the fashion ranks. Chanel Iman has also scored much press coverage as well. The fashion industry thrives on finding new faces – and ethnicity doesn’t seem to be the primary decider in whether a model gets signed by an agency.

By choosing to focus on Iman and Dunn almost exclusively, the press have been omitting other girls who are making a name for themselves. Models like Emma Pei and Toni Garr may not be household names, but they are well-respected and making a handsome living.

So Jourdan is right to challenge the idea of only a few black models working at any one time – we have ample evidence to the contrary. What is more puzzling, and perhaps more unsettling, is the question of why these girls aren’t better known? Is there a cap on success in the fashion industry if you are not white?

We all know that modelling is basically a sales pitch in heels. Whatever is being modelled, sells not just the thing itself, but an aspiration, an idea attached to it that if you buy this dress / bag / tube of lipstick, you will become more beautiful by association.

A quick glance of Jourdan’s CV throws up something troubling. She has had plenty of success on the runways and in landing high-profile editorials and covers, but aside from affiliations with high-street stores Benetton and Topshop, Dunn has no other campaigns to her name. True, Jourdan hasn’t been working that long, but if you compare her CV to that of peer Karlie Kloss , who has already landed a coveted fragrance contract with Marc Jacobs, you can’t help but think that something else is going on here.

We consider ourselves to be living in a multi-cultural society, but the facts do not compare well when we look a little closer at the wider fashion world, beyond the runways and the editorials of high-fashion. If fashion truly does reflect what is going on in society today, then why was Jourdan the first black model to walk for Prada in over a decade?

Many fashion insiders are reluctant to get drawn into the racism debate, not necessarily because they have something to hide, but because with this issue, there are no easy answers.

Casting agents for the big cosmetic firms hire faces on one key component: sell-ability. The controversial, but indisputable fact, when unit sales are directly compared, is that a white / non-ethnic model will sell more tubes of mascara than a black model. This then creates a vicious circle: cosmetic companies may want to go with someone more ethnically-diverse like Jourdan or Chanel, but if a white model sells more products, they have to make a decision based on economics, not aesthetics. By not using a black model, the cosmetic company are then continuing the self-fulfilling prophecy that a white model sells more units, and are then even less likely to use a black model for their next campaign. Consumers then only see white faces in beauty campaigns, and subconsciously make the semantic leap that a paler face is to be interpreted as inherently beautiful. They then respond by buying the tube of mascara, again fulfilling the prophecy that in terms of sales, a white model is a more profitable signing.

This leads back to one question. Why are cosmetic companies using white models so much in the first place? Is it because the public can’t see a black model as being beautiful, and by implication, aspirational? Does the problem lie with the cosmetic companies, or with us, the consumers? Are they in fact only following the agenda that we have set out for them? Who really decides what is beautiful? The problem appears to lie not with reality, but with perception.

For centuries, the template of beauty was not predominantly, but exclusively, white. Beauty was built around European features: big, child-like eyes, small noses and chins. The differing facial proportions on faces outside Europe – Africa, India and Asia – were not considered beautiful because they did not match the European ideal.

The preference for petite features is of course grounded in issues not just of race, but of power and inequality. Those who had the lion’s share of the power set the terms of what was considered beautiful. If you did not match the ideal, you were not beautiful – even if in reality you were actually better looking than your European counterparts: reality and perception – very different things.

The uncomfortable truth is this template has been clearly internalised by all of us. Why else would sales of a magazine cover featuring a black model perform so badly in comparison to those featuring a white model? Even now, it appears the struggle for equal and comparative pegging in the modelling industry is lagging behind the times. If lighter skin and features that lean towards European proportions are still seen as preferable, is there any hope for the industry at all?

The fact that the race issue is being discussed so openly means that there has been a revival of interest on diverse kinds of beauty within the modelling industry. Jourdan Dunn, Chanel Iman, Devon Aoki, Alek Wek, Arlenis Sosa and Emma Pei are proof that the fashion industry is more than willing to employ ethnically-diverse models – not as a gimmick, but because these models are extremely good at what they do.

While this is a debate that will continue to spark discussion, what is good news for models entering the industry today, is that the fashion world itself has no qualms about hiring new faces from around the world.

Part of this has to do with new designers such as Peter Som, Derek Lam and Thakoon coming from diverse backgrounds themselves. Their own history and personal understanding of the race issue makes them in turn more aware – and awareness is the key to breaking down barriers.

American designer Jason Wu used an array of black models for his recent Autumn / Winter and Spring / Summer runways to prove this point. To say that fashion does not regard ethnically –diverse models as being beautiful is simply not true. The problem is with perception: and that problem is centred squarely on consumers’ shoulders. We are the ones not buying it; we still prefer a magazine with a white model on the cover and vote with our cash accordingly. Cosmetic companies choose primarily European models not because of some hidden agenda, but because it is what sells. If we really are serious about wanting to see a more even representation of models out there, on the catwalk, in magazines and campaigns, a conscious effort is required to make it happen.

This changing of attitudes will take time, but there is definitely cause for optimism. The flourishing success of Jourdan Dunn’s career shows how high-fashion is willing to embrace new talent. There is no easy solution to the race issue, but while designers and editors continue to explore the wealth of diverse modelling talent available, there is hope that perception will eventually follow reality. The whole point of beauty is that it is beyond definition.

Fashion likes to think of itself as cosmopolitan and part of that attitude is its openness to new kinds of beauty from around the world. But it will take the continued efforts of high fliers such as Jourdan Dunn to keep reminding us that fairness and equality are always in fashion.

Labels: Benetton, Derek Lam, Elle, Emma Summerton, Jason Wu, Jourdan Dunn, Karlie Kloss, Kate Moss, Peter Som, Storm, Thakoon, Topshop, Vogue

Saturday, 17 October 2009

Take a moment to contemplate these startling figures from the Globe & Mail's ongoing and admirable investigation of the state of the nation's pensions:

• 84% of public service workers have pensions.

• 78% of these plans are gold plated defined benefit pensions

• 25% of private sector workers have a pension plan

• 16% of these plans are gold plated defined benefit pensions

• 11 million workers, or 60 per cent, of Canada’s workers have no pension at all

• 8 million or 45 per cent, have no pensions or registered retirement savings plans (RRSPs)

That's right.

Eight million Canadian workers (45%) have no pensions or RRSPs; they will depend on the pitifully small handouts grudgingly provided by the Harper Tories, who have run up a huge deficit through their incompetence and untrustworthiness.

And eleven million workers (60%) have no pension at all.

Just hope that you don't grow old in the near future. With the structural deficits brought to you by our piano-playing and stock-picking (The recession is a good time to buy shares …) prime minister, your chances of living out your life as poor senior are high indeed, if you belong to these groups.

Of course, if you are a Tory Cabinet minister, you will probably not notice the monthly cheques from CPP…

Here is one problem for Michael Ignatieff to mull over: only one in four of voters 45 years old or older favour the Liberals, while almost half prefer the Tories. The Conservatives have walloped the Liberals by opening up a huge gap in potential support amongst the older voters.

The EKOS poll of October 15, 2009 shows that amongst those 65 and over, a startling 50.3% favoured the Conservatives, compared to only 27.7% for the Liberals. Amongst the 45 to 64 year old group, the Tories lead with 44.5% compared to the Liberals' 25.1%.

But do not abandon hope, All Ye Liberals!

There is a chance for the Liberals to present a policy to the voters which could dramatically change the relative support of the two national parties by older Canadians.

That opportunity arises from a simple fact: millions of Canadians do not have any or adequate pensions, other than the pitifully small CPP and OAS.

Today's Globe & Mail introduces a week long series dealing with the appalling state of the nation's pensions, and the reluctance of federal and provincial governments to publicly recognize the problem, and to protect older Canadians.

This gives us the chance to forge policies which promise all Canadian seniors a decent life after retirement. This will require the Liberal Party to be bold and innovative, but by staking out the territory of pension reform, the party could win over a big chunk of the senior vote (remember, more seniors actually vote in elections, far more than other age groups do), and at the same time fill a vacuum in our political space left by the timorous right wing Harper minority government, and the equally fearful provincial governments.

How big is the problem?

Consider these facts:

"Another set of poorer Canadians should never have had the illusion of security in the first place. A large proportion of workers - 44 per cent, or eight million Canadians - have neither an RRSP nor an employer-based registered pension plan. A growing proportion is self-employed. They will depend on the Canada and Quebec Pension Plans and government backstops like Old Age Security. These provide basic assistance, but little more. The maximum CPP monthly payment for a 65-year-old is $908.75. Unless blessed with other assets, a senior who relies on the public system alone lives a life of poverty."

Ignatieff can start by reading the G&M editorial, which contains these suggestions:

"With so many Canadians at personal financial risk, a new approach is needed. Regulators must be more active in monitoring plans between official evaluations. Governments should facilitate the creation of multi-employer pension plans, whose scale can help spread risk and attract workers from smaller workplaces; new plans could get tax credits to encourage their growth. Commitments inherent in existing defined-benefit plans should be legislatively enshrined, so that they cannot be lost in bankruptcy or squandered when good times make plan administrators succumb to the temptation to reduce incoming payments. The principle, outlined by University of Toronto professor Keith Ambachtsheer in an unpublished paper, is that "accruing pension promises must be fully costed and fully funded at all times."

But employers do not need to wait for the government's hand. They can ensure their plans are better funded by setting higher default contribution rates from employees. Other employers can facilitate payroll deductions to the savings account of the employee's choice. As long as these schemes, or "nudges," as described by the economists Cass Sunstein and Richard Thaler, still leave the ultimate choice on whether to participate in the hands of individual workers, they should be pursued widely. And employers must see the larger public benefits that come with their sponsorship of pensions."

For starters, the Liberal Party should consider making it obligatory for each and every employed or self-employed Canadian to make larger contributions to a revised pension plan, with contributions to the pension plan from both the employer and the federal government. Then the LPC can implement some of the other recommendations of the G&M.

But we should be bold, and innovative, and by so doing, differentiate ourselves from the Harper Tories, who have proven themselves incompetent and untrustworthy in many things, including protecting senior Canadians.

Let us entrench the right of our senior citizens to a decent standard of living after their retirement in our laws, and take steps to make that happen.

Labels: Liberal Party, pensions, policies